Want To Sell Your MSP? You Need EBITDA

Last Updated: October 29, 2022

In today’s post, I want to open up the curtain a bit on what selling your MSP one day might look like and why many owners of managed service providers are doing themselves a big disservice when it comes to the way they are looking at how they operate their business. I want to share this post because most MSP owners quite frankly are not business people, they are technicians. That’s not to say they aren’t smart people, but MSP owners are naturally very structured people, very task-oriented, and oftentimes introverted. I have far too many sales conversations with MSP owners with 10-20 employees and over a million in annual recurring revenue, but are critically low on new business opportunities and desperate for new leads, but are just far too timid when it comes to investing in marketing and sales. This is a big mistake that is going to cost them a lot of money down the line, and potentially leave them in a position of a retirement that does not reflect their expertise or the value that they provided in the marketplace. In this post we’ll talk about why making the investments into marketing and sales to grow your MSP from the 500k-1.5 million ARR range up to the 3-5 million ARR range can equate to a much larger payout when it comes time to sell.

What Is EBITDA?

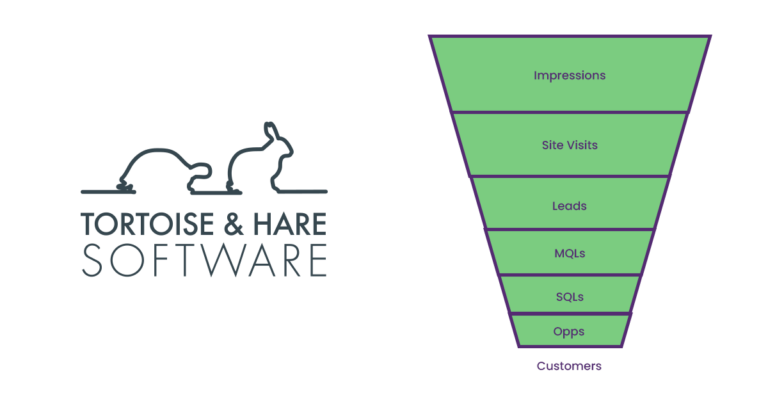

EBITDA is a metric every MSP owner should know but just in case you aren’t talking to your accountant at the moment we’ll clarify it here quickly. EBITDA stands for Earnings Before Interest Taxes Depreciation And Amortization and is the primary way that service business, such as an MSP is going to be valued when it comes to a sale. It’s a very popular metric for VCs, private equity, firms, and other potential buyers to value your MSP because it somewhat eliminates industry subtleties when it comes to tax rates and interest rates and makes it easy to assign a multiple to EBITDA to value a business.

Why EBIDTA Is The Number One Financial Performance Metric You Should Focus On

You’ll hear a lot of MSP owners talk about their business in terms of their annual recurring revenue. While that’s a fun way to look good at the bar after the latest industry conference it’s rarely the metric a potential purchaser will look at when they look to acquire a business. They will look at your EBIDTA and they will assign a multiple of your EBIDTA as a purchase price for your MSP. That multiple will go up the higher your EBITDA is and not the higher that your annual turnover is. An MSP with 3 million in annual turnover but 1 million dollars in EBITDA will sell for more than an MSP with 5 million in annual turnover, but only half a million in EBITDA.

What Is An Approximate EBITDA Multiple For An MSP Sale?

Pay attention here because this is the most important part of this post. An MSP with under a million dollars in EBIDTA is very likely to get a 2x multiple on EBITDA or possibly a trailing twelve months revenues (TTM) valuation. An MSP with a million dollars in EBIDTA is more likely to get a valuation that is in the 4-5x range, and an MSP with 5 million in EBITDA may command an 8-10x multiple or more.

Let’s pretend we have an MSP that is able to create earnings within their business that are approximately 30% of their annual revenues and look at what the potential sale price of their MSP may be.

| MSP | ARR | EBITDA | Multiple | Sale Price |

| Joe Schmoe MSP | $1,000,000 | $333,000 | 2x | $666,000 |

| Ambitious MSP | $3,000,000 | $1,000,000 | 4x | $4,000,000 |

| Yacht Party MSP | $15,000,000 | $5,000,000 | 10x | $50,000,000 |

These may not be the exact multiples that your MSP can command and 30% of revenue may be an ambitious amount of earnings. Everything in sales is what you can convince someone to pay for it, but technology businesses tend to command slightly more favorable multiples than say a marketing agency or a recruiting firm might command. But the point is this. If you’re going to spend a significant portion of your life running an MSP, and undertaking all the stress that’s involved, you might as well come out the other side with an attractive business to sell and comfortable retirement. To do this, you must pump up your earnings and scale your business so you can command a higher multiple when it comes time to sell.

How Do I Increase My Earnings?

Increasing your EBITDA requires two things, increasing your sales volume and increasing your profitability. The only way to bring on highly profitable clients is to create demand for your services. When you have a steady stream of opportunities you can say no to bad fit clients and pick and choose the clients that will help you build a valuable business to a purchaser. To do this you have to invest in marketing, you have to invest in sales, and you have to bring on the right clients that you can deliver a valuable enough service to your clients that they are willing to pay a premium for your service. As your MSP increases in size and you move upmarket, the number of MSPs that can adequately service larger firms shrinks. This allows them to charge more than at the small business level which increases the profitability of your firm and makes it more attractive when it comes time to sell.

Final Thoughts

Too many MSP owners don’t understand the financial impacts of not treating their MSP seriously when it comes to marketing and sales. If you do good work and have a solid number of industry contacts, it’s not unusual to see an MSP grow to the 500k-1.5 million in annual revenue range almost solely on referrals. This is not an achievement to scoff at, but it is a point where a lot of MSPs tend to get stuck and rest on their laurels instead of pushing forward and making the changes they need to scale their business up, create a reliable stream of quality MSP prospects to close and grow their recurring revenues. The challenges of a 5 million dollar business aren’t all that different from a 1.5 million dollar business and in a lot of ways, it starts to get easier because you have the teams in place and the specialization of resources needed to operate efficiently. It certainly won’t be easy but it’s not worth leaving millions of dollars on the table when it comes time to sell because you didn’t even try to scale. So what are you waiting for? Get started!

Leave a Comment