How Much Can I Spend On Google Ads?

Last Updated: February 11, 2021

One of the first questions I get when talking about google ads is how much is a click? It’s a fair question, but asking it is the wrong way to think about advertising via Google Ads. This is an expense focused question and the whole purpose of engaging a Google Ads management agency or getting started with it on your own is to generate revenue. With that in mind, a better question to ask is, how much can I afford to spend on Google Ads clicks to acquire a customer profitably? Well there’s a simple answer to that question and there a more complex answer to it. In this post we’ll dive in to some of the math that goes behind what you can afford to spend on Google ads.

Simple Cost Per Click Calculation

Remember how I told you there’s an easy way to calculate how much you can afford to spend on pay per click? Well here it is. You can afford to spend your gross profit. You can afford to pay up to your gross profit times your conversion rate for a click on average. Let’s say you make $100 in revenue and your cost of goods sold (COGS) is $30. That would mean your gross profit is $70. If your ads convert at a 3% conversion rate then you can afford to pay $2.10 per click on average.

$100 Revenue - $30 Cost of Goods Sold = $70 Gross Profit $70 Gross Profit * 3% conversion rate = $2.10 Cost Per Click

This is the theoretical maximum available customer acquisition cost you can afford to spend without losing money. Of course running a business often has a goal of making some money along the way, so it’s a good idea to bake in a desired profit into your calculations. Let’s say you have a target profit margin of 20%. In our simplistic example we would want to add that desired profit figure to our cost of goods sold when calculating what we can afford to spend to acquire a customer.

$100 * 20% Desired Profit Margin = $20 Desired Profit On Sale $100 Revenue - $30 Cost of Goods Sold - $20 Desired Profit = $50 Available Acquisition Expense $50 Available Acquisition Expense * 3% conversion rate = $1.50 Cost Per Click

The $50 available acquisition expense above is rolled up into a line item on income statements called selling, general, and administrative or SG&A. Cost per click expenses to acquire sales are similar to the cost of a salesman doing the selling offline. It’s important to understand that every business is going to have general and administrative expenses for things like running payroll, managing vendor relationships, and other items not related to the production of goods. These general and administrative expenses are spread out over the cost of your entire sales volume and usually wind up being negligible in the context of calculating cost per click, but you may want to factor in some additional breathing room to cover general and administrative expenses.

Introducing Customer Lifetime Value

In the real world most sales are not going to be exactly $100 and the lifetime of a customer will typically extend past the initially placed order. To describe this, pay per click experts and marketers like to look at a metric known as average customer lifetime value (ALCTV or sometimes CLV or LTV). Established businesses with adequate record keeping should be able to look at historical customer records and get an estimate of what the lifetime value of a customer may be. For instance a managed service provider acquires a customer that purchases an initial fixed fee project for $4,000 and also signs a $1,500/month ongoing managed services contract and remains a customer for 2 years.

$1,500/month * 24 months + $4,000 Initial Project = $40,000 Customer Lifetime Value

Additional considerations can be made such as if acquired customers go on to refer additional customers that add to the lifetime value, but often times such a granular and speculative look is omitted.

Let’s say that between fractional usage of help desk employees, network engineers, cloud engineers, and other resources that it costs the business approximately $20,000 of salaried employee’s available utilization to service the account. That would leave a $20,000 customer acquisition cost. Subtract out a desired profit margin of 20% and a 5% cushion for general and administrative expense.

$40,000 x 20% Profit Margin = $8,000

$40,000 x 5% General & Admin = $2,000

$40,000 Customer Lifetime Value – $20,000 Cost of Goods Sold – $8,000 Profit Margin – $2,000 General & Admin = $10,000 available acquisition expense.

Cost Per Lead Calculation

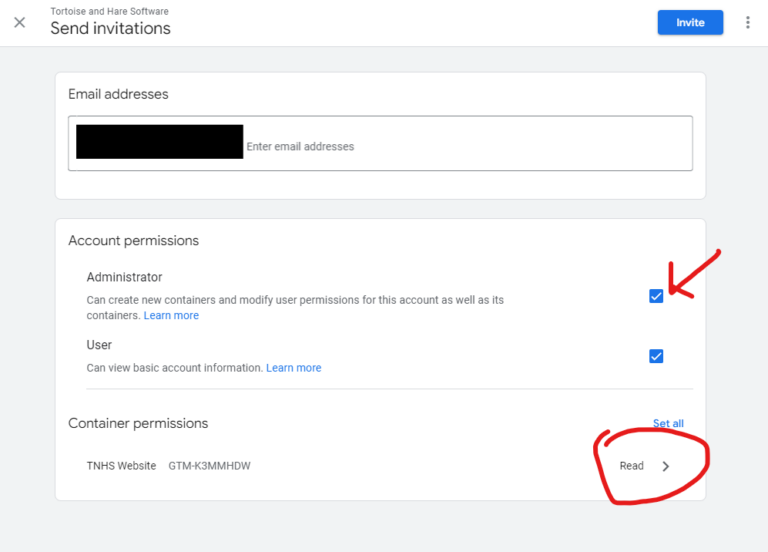

Our cost per click calculation above makes sense for ecommerce business where a conversion translates directly to a sale and revenue. For service business there is usually an extra layer involved because every conversion is going to generate a lead and not necessarily a sale. Service business are going to need to get a handle on another metric known as their lead to close ratio. In our customer lifetime value example above where we show a $10,00 available acquisition expense for a managed service provider it would be a huge mistake to multiply your acquisition expense by your conversion rate and assume that’s a fair cost per click. You also need to factor in your lead to close sales rate. This can vary wildly depending on how picky the business is about qualified leads. The further up market you move, the more likely it is your lead to close sales rate drops. Let’s say the close rate here is 20%.

$10,000 Available Acquisition Expense * 3% Conversion Rate * 20% lead to close rate = $60 Maximum Cost Per Lead

A SaaS company will have a similar calculation, but you can sub out leads for free trials or demo requests and “close rates” for subscription rates.

Conclusion

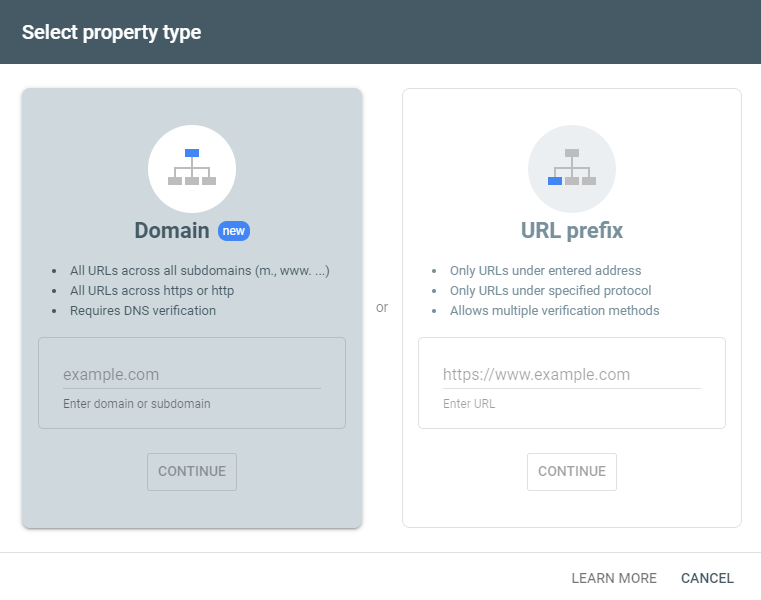

Google Ads can be a powerful channel to generate business from, but it requires getting a firm handle on the value of a customer, realistic profit margins, and additional non production expenses that fall under the general and administrative categories. Google Ads provides lots of great tools to help you generate conversions at a desired cost. We went through several calculations for determining realistic cost per clicks and costs per lead in this article. These were just example numbers and can be significantly influenced by increasing conversion rates, revising profitability targets, increasing your lead to close sales ratios, or increasing lifetime customer values. Working with an experienced marketing consultant can help you make decisions that contribute to gains in many of these areas. Reach out to Tortoise and Hare Software today for help getting started with Google Ads.

Leave a Comment